Set up fiscalization compliance - Italy

The Italian fiscalization is based on the POS system integration with the fiscal printer (RT device) that communicates with the tax authority (TA) and generates printouts for various processes such as:

- Sales

- Voucher handling

- Discounts

- Return

- Cancellation

- Invoice

- Cash-in/Cash-out

- Reports (X report, Z report and EJ report)

- Receipt copy

- Lottery handling

To ensure compliance with Italian fiscal laws, follow the provided steps:

Navigate to the IT Tax Fiscalization Setup page, and enable the fiscalization via the toggle switch.

Open the POS Audit Profiles administrative section, enable the audit log, and set the Audit Handler to IT_ENTRATE.

Make sure this audit profile is set for all POS units from the POS Unit List that need to be compliant with Italian fiscalization laws.

Move on to the IT POS Unit Mapping page, and enter the Fiscal Printer IP address for the POS unit connected to the printer, and set the Fiscal Printer Rounding Type to Standard Rounding.

To obtain the Fiscal Printer RT Type and Fiscal Printer Serial No., create a POS button using the IT_PRINT_MGT action, and set the parameters to Get Fiscal Printer Model.

The Fiscal Printer RT Type and Fiscal Printer Serial No. fields are populated after the RT Printer Type and RT Serial No. are executed from the POS.To be able to log into the printer, create a POS button using the IT_PRINT_MGT action, and set the parameter value to Log in Fiscal Printer.

Ensure that the printer’s password, stored in IT POS Unit Mapping under Fiscal Printer Password, is correctly configured.

When triggered, the IT_PRINT_MGT action takes the printer’s password from IT POS Unit Mapping and logs into the fiscal printer with it.Set up the action to get the fiscal printer VAT codes. The action is IT_PRINT_MGT while its parameter should be set to Setup Printer.

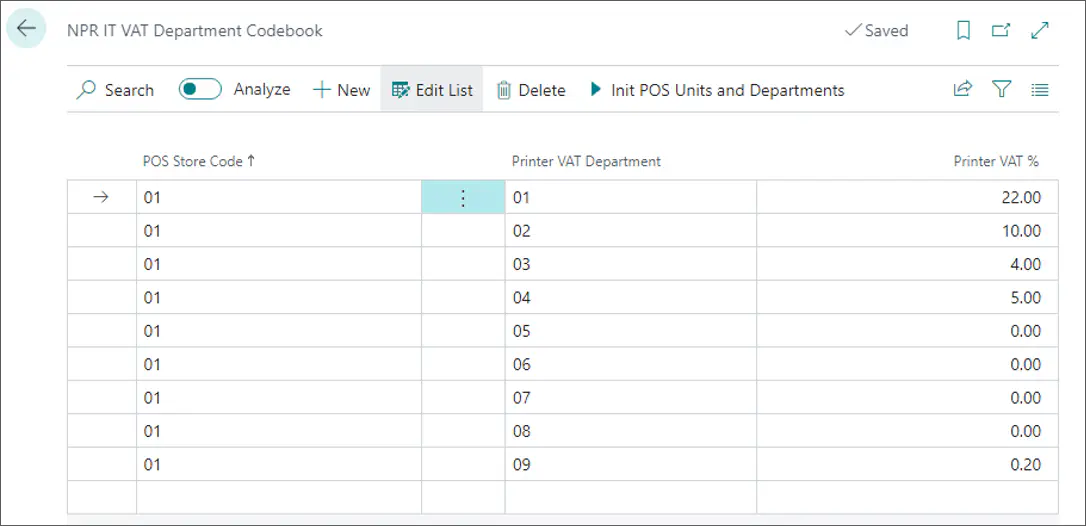

The action should be run from Function Menu on POS Login page.VAT department codes are listed in the NPR IT VAT Department Codebook table.

The VAT % column contains all possible VAT rates for Italian compliance. According to the VAT % set in the VAT Posting Setup table, when a sale is made from the POS, the printer gets the VAT department number, and uses it for printing the correct VAT rate on the receipt.

From the IT POS Payment Method Mapping table, choose the POS payment method corresponding to the Italian fiscalization payment methods from the IT Payment Method field.

Assign a unique IT Payment Method Index to each payment method.

The index value determines how cumulative payment amounts are grouped in X and Z reports.

The following range (possible variants of payment methods) of index values is available for printer payment types:

- 0Cash – 0-5

- 1Check – N/A

- 2Credit card – 0-10

- 3Ticket – 1-10

- 4Multiple tickets – 1-99

- 5Not Paid – 0-Mixed (goods and services);1-goods; 2-services; 3-Invoice to follow; 4-RT invoice;5-national health

- 6Payment discounts – 0-generic; 1-multi-use voucher

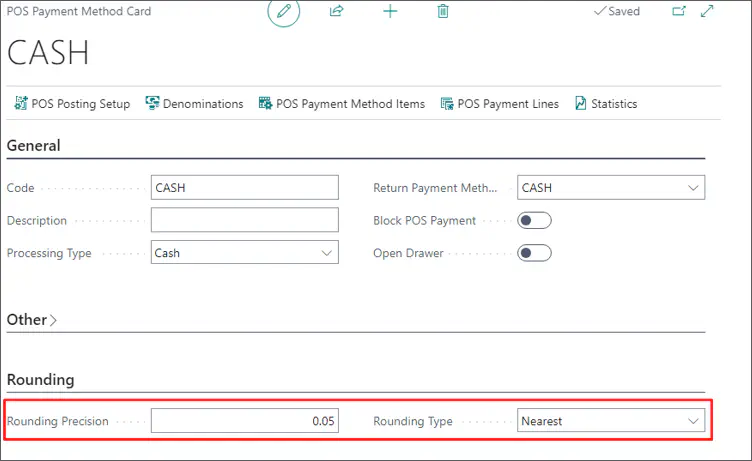

Set rounding for cash payments.

Refer to the following rules:- 1 and 2 cents -> rounding the account down to a round figure (e.g. € 9.31 -> € 9.30)

- 3 and 4 cents -> rounding off the account to 5 cents upwards (e.g. € 9.33 -> € 9.35)

- 6 and 7 cents -> rounding off the account to 5 cents down (e.g. € 9.37 -> € 9.35)

- 8 and 9 cents -> rounding of the account to a round figure upwards (e.g. € 9.38 -> € 9.40)

On the POS Payment Method Card for cash payments, set the Rounding Precision to 0,05 and the Rounding Type to Nearest.

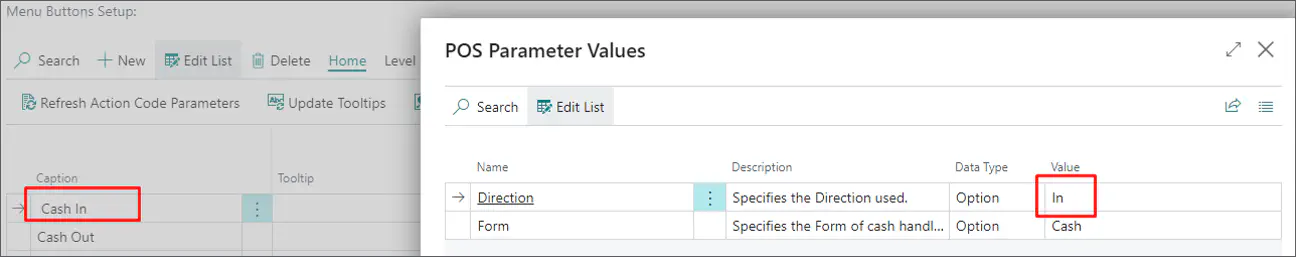

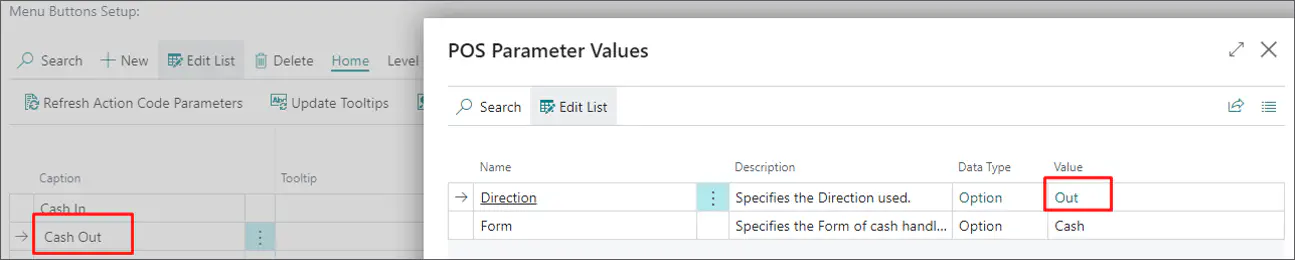

Create the buttons for Cash In and Cash Out using the IT_CASH_MGT action.

For cash-in, set the parameter value to In, and for cash-out, set the parameter value to Out.

When performing this action on POS, enter the amount transferred to or from the cash register, and then confirm the transaction to print the configuration document that the money has been transferred. This action only updates the printer memory.

When performing this action on POS, enter the amount transferred to or from the cash register, and then confirm the transaction to print the configuration document that the money has been transferred. This action only updates the printer memory.

Additional setup and usage

Issue lottery code

- Create a POS button for the action IT_LOTT_CODE.

- Before choosing the payment method to finish the sale, enter a lottery code.

- Complete the sale with a desired payment method.

The lottery code will become visible on the receipt below the receipt number.

Print fiscal reports

It is possible to print the end-of-day report (Z report), X report, electronic journal report, and periodical report.

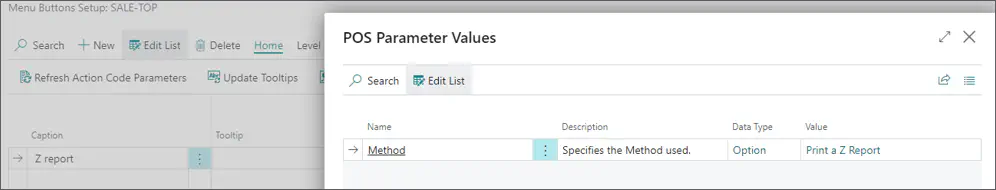

Z report

Create a POS button for the action IT_PRINT_MGT.

Set the parameter value to Print a Z report.

Execute the action on the POS to print the end-of-day report.

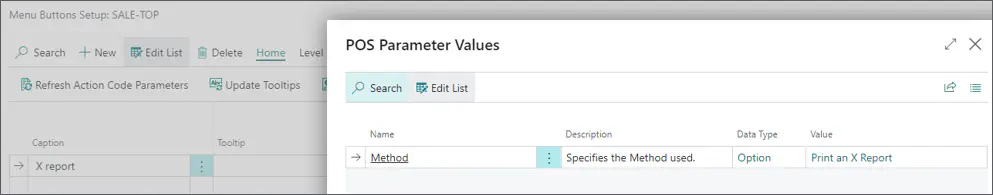

X report

Create a POS button for the action IT_PRINT_MGT.

Set the parameter value to Print an X report.

Execute the action on the POS to print the X report.

It shows the current balancing stated on the printer.

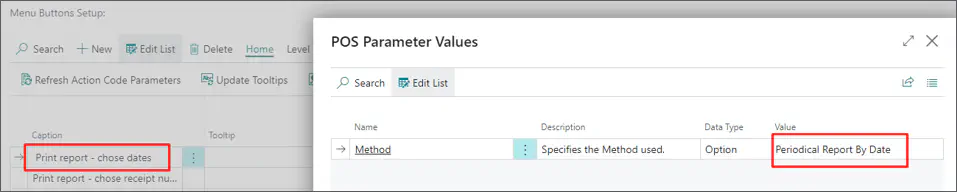

Periodical report

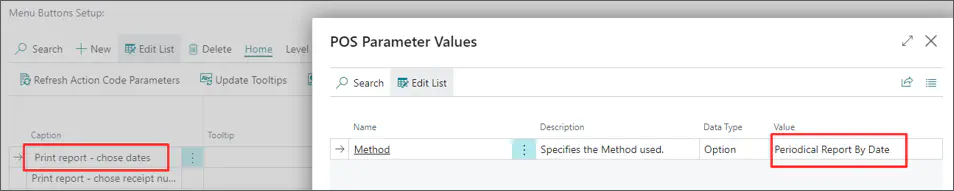

Periodical reports can be printed by two methods – by choosing dates and by choosing receipt numbers.

Create POS buttons for both options by using the action IT_EJ_REPORT.

Choose the option for printing by setting the necessary parameters.

Receipt duplicate

- Create a POS button for the action IT_PRINT_MGT.

- Set the parameter value to Print Last Receipt.

- Execute the action on the POS to print the duplicate of the last printer receipt.

Receipt copy

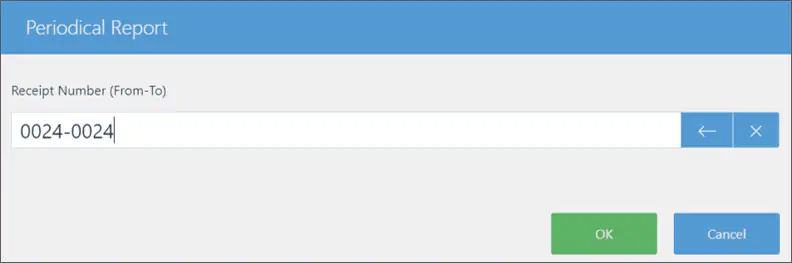

Create a POS button for the action IT_EJ_REPORT.

Set the parameter to Periodical Report By Receipt Number.

The receipt numbers (from-to) should be the same, as displayed in the following screenshot: