AT POS Audit Log (Austrian fiscalization)

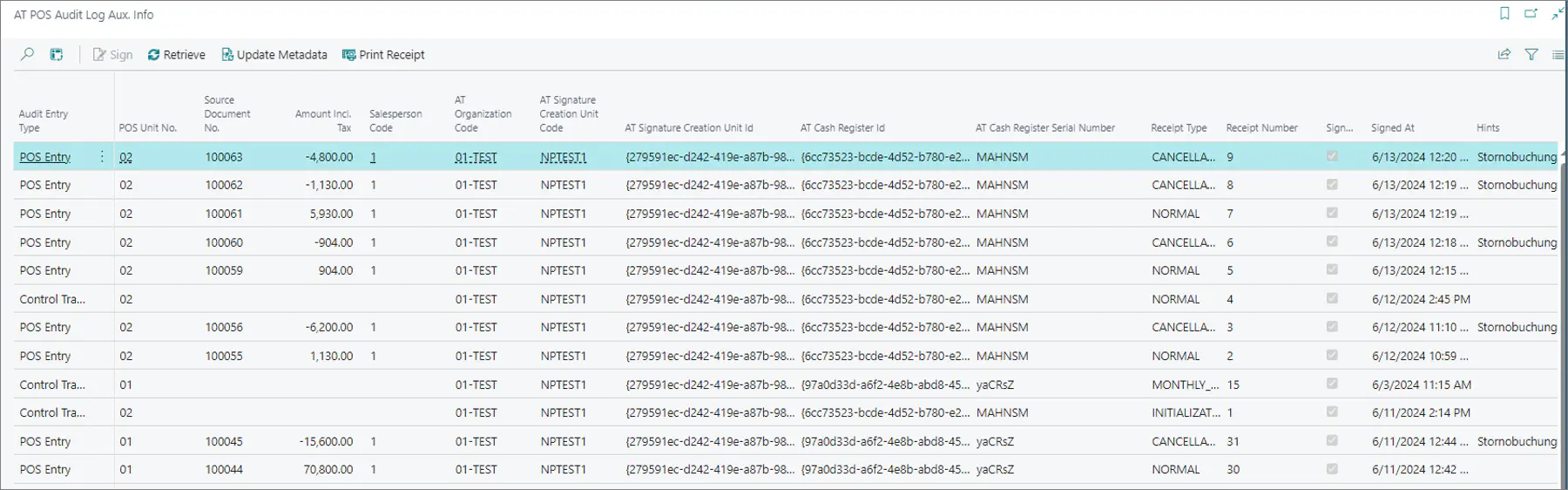

All transaction data tied to POS compliant with the Austrian fiscalization laws is recorded in the AT POS Audit Log Aux. Info administrative section.

The following information can be learned from this table:

| Field Name | Description |

|---|---|

| Audit Entry Type | Specifies whether the transaction is related to the POS entry or the cash register. Cash register transactions are connected to the initialization or decommission of the POS unit. |

| AT Organization Code | Specifies the code pertaining to the cash register registered with Fiskaly. |

| AT SCU Code | Specifies the information pertaining to the SCU created for the given POS unit from Fiskaly. |

| AT SCU ID and AT Cash Register ID | Provides identification for the POS clients created with Fiskaly. |

| AT Cash Register Serial Number | Specifies the unique serial number related to the registered Fiskaly client. |

| Receipt Type | Specifies the status of the receipt (transaction), e.g. normal, cancelation, training, initialization, decommission, yearly_close, monthly_close, signature_creation_unit_fault_clearence. |

| Hints | Specifies the receipt type information that Fiskaly provides, and that is printed on the receipt. |

| FON Receipt Validation Status | Specifies whether the transaction validation from FON was successful or not. |

| Receipt Number | Specifies the receipt number generated per each POS unit (AT cash register). |