Set up fiscalization compliance - Austria

On this page

NP Retail is integrated with the Fiskaly API solution that makes the usage of NaviPartner’s POS solution compliant with Austrian fiscal laws.

To configure NP Retail for compliance with Austrian fiscal laws, follow the provided steps:

Navigate to the AT Fiscalization Setup administrative section.

Enable the AT Fiscalization Enabled toggle switch.

The Fiskaly API URL field is automatically populated as a result.Expand the FinanzOnline Credentials section, and populate the available fields.

The FinanzOnline credentials are unique for each company/legal entity. They are provided by FON when a client registers as a FinanzOnline Cash Register web service user. More information can be found in the FinanzOnline handbook (pages 60-63).Create a POS audit profile that will be used for all POS units that are going to be used. Make sure the following configurations are applied:

- Select AT_FISKALY as the Audit Handler.

- Make sure the Audit Log Enabled toggle switch is active.

Open the AT Organizations page from the AT Fiscalization Setup ribbon.

The AT organization can be created for a company or on a POS store level.Create a new AT organization.

Provide the API Key and the API Secret in the AT Organization Card.

Both pieces of information are obtained from the Fiskaly Dashboard as soon as the Fiskaly organization is created.The information should immediately be copied from the Fiskaly Dashboard and entered in these fields, as it's displayed on the Dashboard only temporary.To authenticate the organization, use the Authenticate FON action in the ribbon.

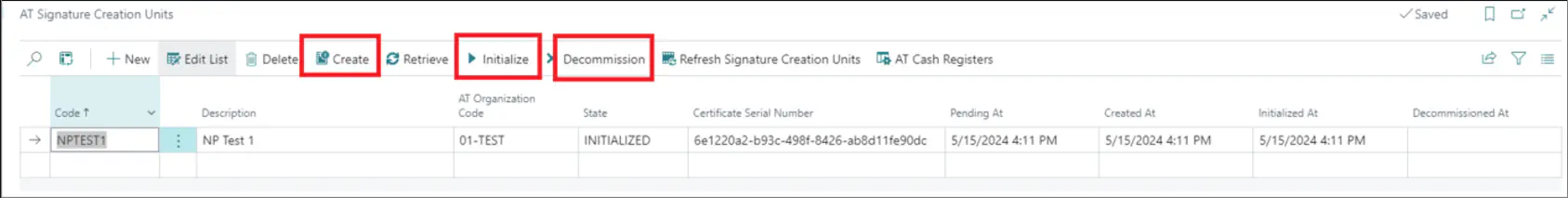

Create a Signature Creation Unit (SCU) following the organizations’ successful authentication.

The SCU is created on the entire organization level. It is used for signing transactions made on the POS. Each transaction is signed.Provide the Code, Description, and select the authenticated organization in the AT Organization Code field.

When all date is input, click Create to create the SCU for this organization, and then click Initialize.

If the SCU is no longer in use, it should be Decommissioned, after which it won't be possible to use it again.

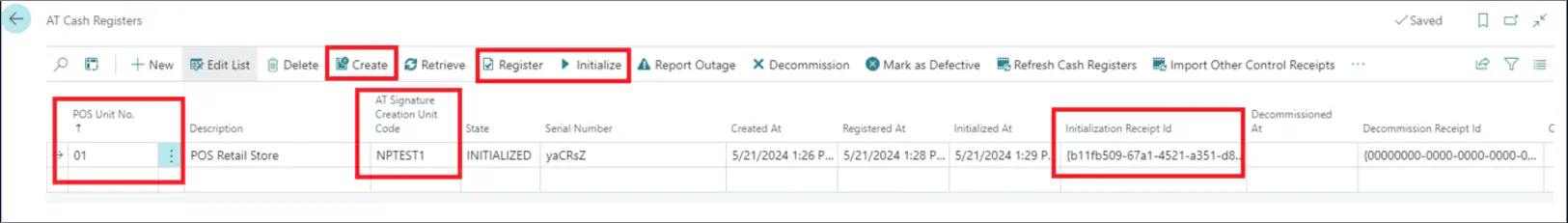

Navigate to the AT Cash Registers administrative section.

After the SCU has been created and initialized, it’s necessary to connect the POS units with it, so that a transaction is signed every time it is made from the POS unit.Select a POS unit from the POS Unit No. dropdown list, then select the previously created SCU code from the AT Signature Creation Unit Code dropdown list.

Execute the Create, Register, and Initialize actions (in that order) to activate the cash register.

A transaction will be created and recorded in the AT POS Audit Log after it’s been initialized.

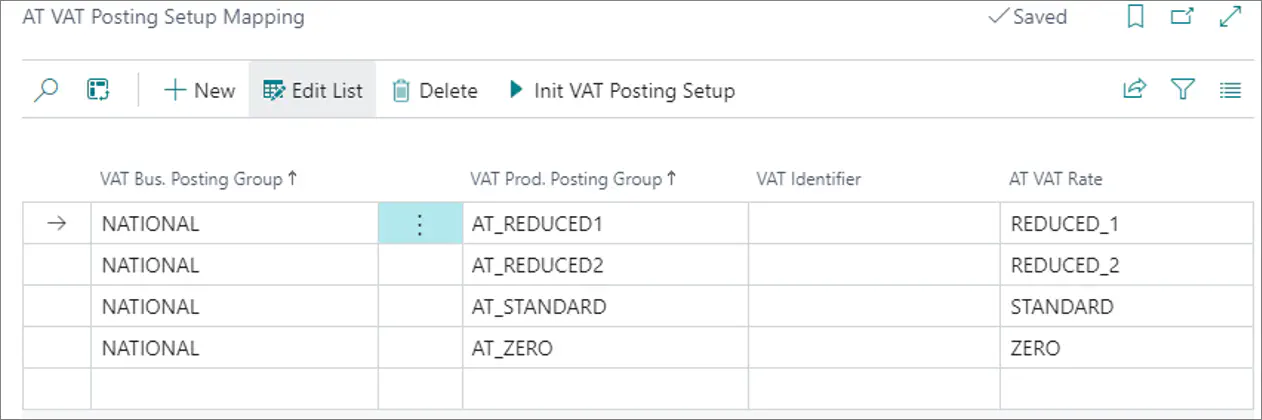

Navigate to the AT VAT Posting Setup Mapping administrative section, and set the combination of VAT Business and VAT Product posting groups.

The combination needs to be compliant with the permitted VAT rates in Austria, and they need to match the existing combinations set on the standard VAT Posting Setup table.

It’s possible to insert all combinations from the VAT Posting Setup by executing the Init VAT Posting Setup action.

Navigate to the AT POS Payment Method Mapping administrative section, and choose the POS payment methods you wish to use, then connect them to the related AT Payment Types.

The payment methods need to have been previously created in the standard POS Payment Method List.Click Init Payment Methods to insert all payment methods.

Cash transactions are all payment made in cash, but they also include credit/debit card payments, gift cards/vouchers, and any other cash substitutes, while bank transfer is a non-cash transaction.